Press Release: Council tax increases undermine the levelling up agenda

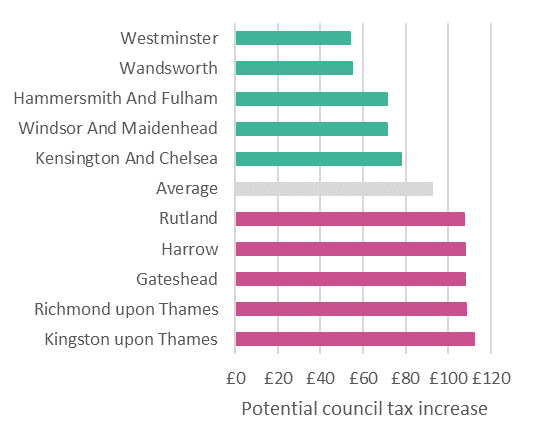

- The government’s proposed council tax increases will hit some places more than others. For example, Band D households in Gateshead could see their council tax go up by £108 (to £2,153) compared to £54 (to £836) in Westminster for 2021/22.

- These increases will only compound existing differences in council tax paid between local authorities in England and undermine the government’s plan for fiscal policy that drives both economic recovery and levelling up.

New CPP analysis shows for the first time how the proposed rise in council tax is unfairly distributed between places. Reform is sorely overdue. The expectation of Chancellor Rishi Sunak for councils to increase council tax by up to 5% will mean very different things for households and local councils in different parts of the country. Whilst the proposed percentage increase in council tax is uniform across the country, the starting point in absolute terms is very different. This means that the same percentage rise will exacerbate gaps in the tax paid by residents and manifest England’s council tax postcode lottery.

For example, if we follow the Chancellor’s assumption that councils increase tax by the maximum allowed, Band D householders in Gateshead’s council tax could go up in April by £108 for 2021/22 compared to an increase of £54 in Westminster.

There is no clear geographic pattern to the variation in rates, nor do they correlate with socioeconomic indicators. Rates are low in Windsor and Maidenhead and high in nearby Woking, high in Liverpool and low in nearby Wigan. The lack of economic reasoning for why these rates differ between places means that raising it will not support the government’s twin aim of economic recovery and levelling up the country and, at worst, undermine it.

Figure 1: Potential Band D council tax increases in 2021/22 for selected local areas, assuming maximum allowed increases are implemented (full list here)

What can be done?

Whilst momentum builds for broader reform, there are changes that the government can make to reduce unfair variation in council tax. CPP calls on the government to delay local tax increases and then help to address the unfair variation in council tax by:

- Calculating central government grant on local tax base not historical tax take;

- Lowering the council tax threshold assumed in calculating grant funding beneath the 5% maximum and allow councils to keep any additional money raised from between the threshold and 5%

John Dudding, Research Analyst, Centre for Progressive Policy says:

The government’s decision to increase council tax this year goes against the economic consensus not to raise taxes during a significant double dip economic downturn.

By choosing council tax itself, the burden of this tax will vary greatly from place to place with the absolute increases twice that in some areas than others. These differences have little rhyme or reason, being mostly based on decisions made in the 1990s and 2000s, with subsequent central Government policy leaving current council leaders little options to revisit them.

The government needs to delay this year’s council tax increase and then use the opportunity to improve how council tax works for households and communities.

Notes to the editor

- The report can be found here on Wednesday, 20 January, 2021, 00.01am. For enquiries, please contact Thomas Hauschildt, THauschildt@progressive-policy.net.

- See full list of local authorities by potential rise separate to this document and published here.

- Graph: The graph shows potential increase in Band D council tax paid were all relevant authorities to use the maximum increase allowed set out by the Chancellor. This includes tax paid to lower tier and upper tier councils, combined authority, police authorities and fire authorities. Allowable increases are based on the provisional local government financial settlement, except for the Greater London Authority which draws on a subsequent GLA announcement. Some authorities have stated they will not implement the maximum allowable increase.

- About CPP: The Centre for Progressive Policy is a think tank committed to making inclusive economic growth a reality. By working with national and local partners, our aim is to devise effective, pragmatic policy solutions to drive productivity and shared prosperity in the UK. Inclusive growth is one of the most urgent questions facing advanced economies where stagnant real wages are squeezing living standards and wealth is increasingly concentrated. CPP believes that a new approach to growth is needed, harnessing the best of central and local government to shape the national economic environment and build on the assets and opportunities of place. The Centre for Progressive Policy is funded by Lord Sainsbury and hosts the Inclusive Growth Network.

- For more information on the Centre for Progressive Policy, please see www.progressive-policy.net or follow @CentreProPolicy